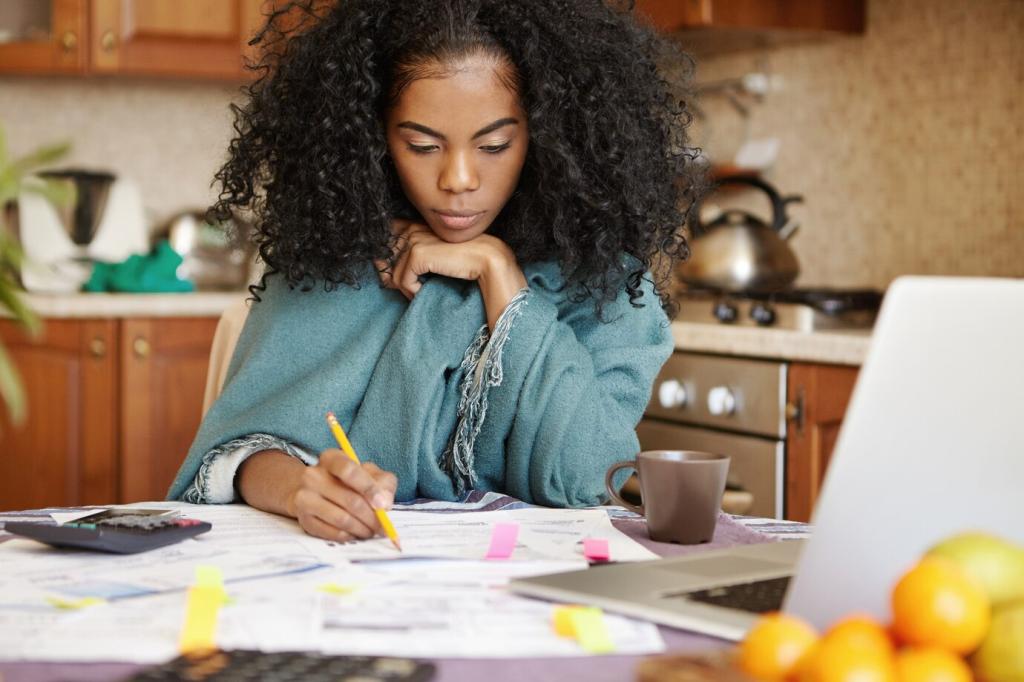

Security, Privacy, and Trust for Automated Money

Require end-to-end encryption, tokenized access, hardware-backed secrets, and monitored anomaly detection. Look for plain-language security pages and independent audits. If a provider can’t explain protections clearly, they haven’t earned the right to automate your financial life.

Security, Privacy, and Trust for Automated Money

You should decide what’s shared, with whom, and for how long. Expect granular toggles, data minimization, and easy deletion. A trustworthy platform treats your information like a loan, not a possession, and returns it when you say so—no questions or obstacles.

Security, Privacy, and Trust for Automated Money

Set limits, approval prompts over certain amounts, and rollback options. Maintain a log of actions with timestamps and reasons. Periodic reviews keep the system honest and your confidence high, ensuring convenience never outruns your comfort or your financial principles.